💡 Why Everyone Is Talking About SIP in 2025

Are you tired of hearing financial experts say, “Start a SIP today!” and wondering what it actually means?

You’re not alone. Many beginners want to grow their savings but don’t know where to start. This guide is written for students, professionals, and beginners who want to build wealth without taking big risks.

By the end, you’ll understand not just the SIP full form, but also how it works, why it’s powerful, and how you can start one today — even with just ₹500. 🚀

🧾 What Is SIP Full Form?

The SIP full form is Systematic Investment Plan.

It’s a smart way to invest regularly in mutual funds by contributing a fixed amount every month (or week, or quarter).

Instead of investing ₹1 lakh at once, you can invest ₹5,000 per month — making your investment journey consistent, stress-free, and automated.

💬 In short: SIP = “Small, disciplined steps to big wealth.”

📘 Understanding SIP Full Form and Meaning in Mutual Fund

A Systematic Investment Plan lets you invest in mutual funds periodically, regardless of market ups and downs.

Here’s the beauty: when markets fall, your fixed amount buys more units; when markets rise, it buys fewer units. This automatic adjustment is called rupee cost averaging.

It removes the pressure of “timing the market” — something even experts struggle with.

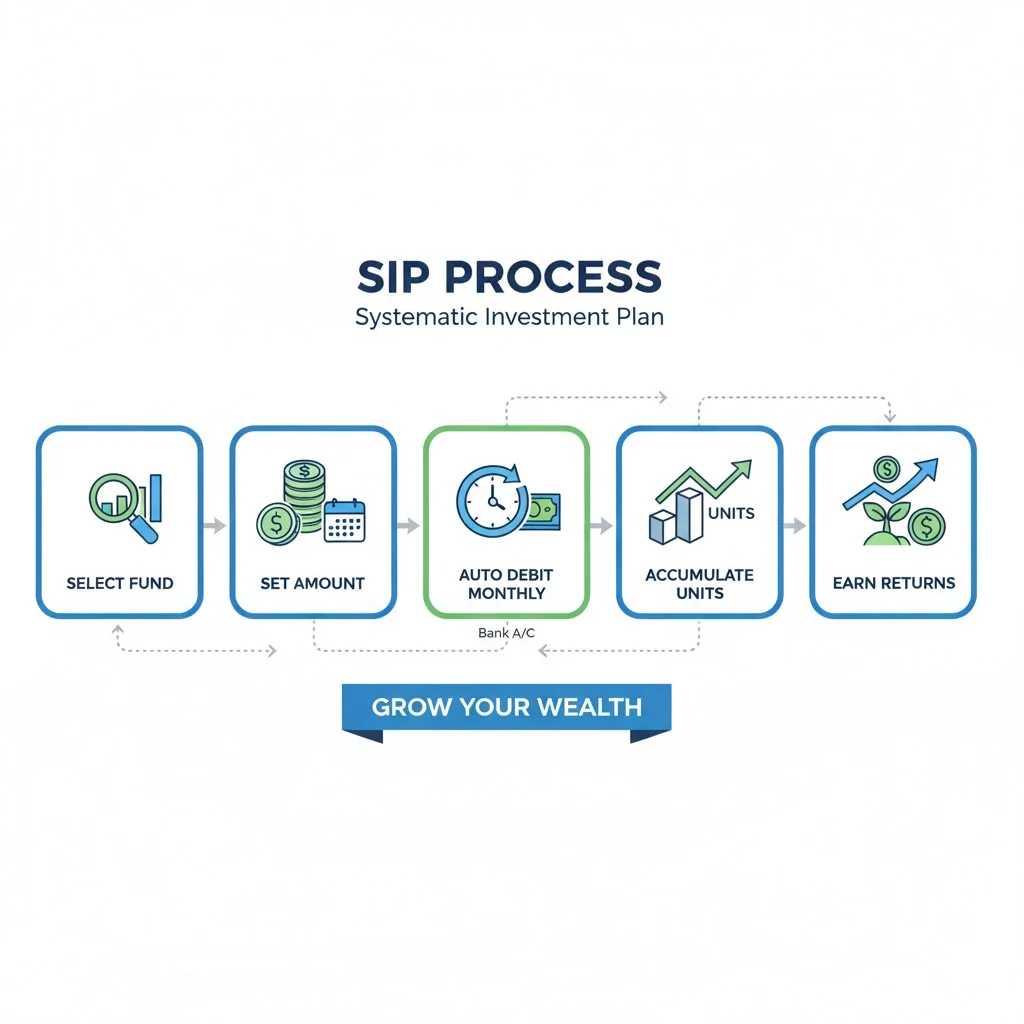

🏦 How Does SIP Work? (Step-by-Step)

Let’s break it down clearly 👇

| Step | Process | Example |

|---|---|---|

| 1️⃣ Choose a Mutual Fund | Select a fund based on your goals — equity, hybrid, or debt | Parag Parikh Flexi Cap |

| 2️⃣ Set SIP Amount | Minimum ₹500 or ₹1000 per month | ₹2000 monthly |

| 3️⃣ Select Frequency | Monthly, weekly, or quarterly | Monthly |

| 4️⃣ Set Duration | Ideal for 3–10 years | 5 years |

| 5️⃣ Auto-Debit from Bank | Automatic transfer on fixed date | Every 5th of month |

| 6️⃣ Sit Back & Track | Monitor performance once a year | Review fund growth |

💡 Alt text for image: “Step-by-step process showing how SIP investment works automatically in mutual funds.”

🪙 SIP Full Form in Banking

In banking, SIP full form also means Systematic Investment Plan, where the bank auto-deducts a pre-decided amount from your account to invest in your chosen mutual fund.

It’s not a savings account; it’s an investment channel managed via your bank’s partnership with mutual fund houses.

💰 Benefits of SIP Investment in 2025

| Benefit | Description |

|---|---|

| Discipline | Encourages consistent savings each month. |

| Rupee Cost Averaging | Buys more units when prices drop and fewer when they rise. |

| Power of Compounding | Returns earn returns — exponential growth over time. |

| Flexibility | Start, pause, or increase your SIP anytime. |

| Affordability | Start with as little as ₹500/month. |

| Long-Term Wealth | Ideal for retirement, education, or home goals. |

📈 Alt text for image: “Chart showing SIP benefits like compounding, averaging, and discipline.”

🧮 SIP Calculator: Estimate Your Returns

Use a SIP calculator to estimate how much your investment can grow.

Example:

If you invest ₹5,000 monthly for 10 years with a 12% annual return:

| Duration | Total Investment | Approx. Value (₹) |

|---|---|---|

| 5 years | ₹3,00,000 | ₹4,20,000 |

| 10 years | ₹6,00,000 | ₹11,60,000 |

| 15 years | ₹9,00,000 | ₹25,00,000+ |

💡 Pro Tip: Increase your SIP by 10% yearly — this “top-up SIP” accelerates compounding.

⚖️ SIP vs Lump Sum Investment

| Factor | SIP | Lump Sum |

|---|---|---|

| Investment Mode | Monthly | One-time |

| Risk Level | Lower | Higher (depends on entry point) |

| Market Timing | Not required | Crucial |

| Ideal For | Salaried individuals | Experienced investors |

| Average Costing | Yes (rupee cost averaging) | No |

| Flexibility | High | Low |

📊 Alt text: “Comparison chart between SIP and lump sum investment strategy.”

🔍 Types of SIP (Systematic Investment Plans)

| Type | Description | Best For |

|---|---|---|

| 1️⃣ Regular SIP | Fixed amount every month | Beginners |

| 2️⃣ Top-Up SIP | Gradually increase your SIP each year | Salaried investors |

| 3️⃣ Flexible SIP | Adjust amount anytime | Freelancers |

| 4️⃣ Perpetual SIP | No fixed end date | Long-term investors |

| 5️⃣ Trigger SIP | Auto-invest when certain market conditions are met | Advanced investors |

Alt text: “Illustration of different SIP types – regular, top-up, flexible, perpetual, trigger.”

📊 SIP Trends in India 2025

According to AMFI (Association of Mutual Funds in India), the popularity of SIPs has skyrocketed:

- Total active SIP accounts: 15.2 crore+

- Monthly SIP inflows (Sept 2025): ₹19,200 crore+

- Average SIP size: ₹3,200/month

India’s young professionals (ages 22–35) now make up 60% of new SIP investors.

Alt text: “Graph showing rising SIP inflows and investor growth in India 2025.”

📈 Best SIP Plans in India (2025 Updated List)

| Mutual Fund Scheme | Type | 5-Year Return (%) |

|---|---|---|

| Parag Parikh Flexi Cap Fund | Flexi Cap | 17.2% |

| Axis Bluechip Fund | Large Cap | 14.8% |

| Mirae Asset Large Cap Fund | Equity | 15.1% |

| SBI Small Cap Fund | Small Cap | 21.9% |

| ICICI Pru Balanced Advantage | Hybrid | 12.3% |

📘 Source: AMFI India

🧭 How to Start a SIP Online in 2025

- Choose a trusted platform — Groww, Zerodha, or Kuvera.

- Complete KYC verification (takes 5 minutes).

- Select mutual fund category — equity, debt, or hybrid.

- Set SIP amount and frequency.

- Activate auto-debit.

- Track progress monthly.

🪙 Alt text: “Screenshot example of SIP setup through online mutual fund app.”

🧠 Common Myths About SIP (Busted!)

| Myth | Reality |

|---|---|

| SIP = Mutual Fund | SIP is the method to invest in a mutual fund. |

| SIPs Guarantee Returns | Returns depend on market performance. |

| SIPs Can’t Be Stopped | You can pause or stop anytime. |

| SIPs Only for Rich | Start with ₹500/month. |

| SIPs Are Risk-Free | Risk varies by mutual fund type. |

📚 Important SIP Terms You Should Know

| Term | Meaning |

|---|---|

| NAV (Net Asset Value) | Price per mutual fund unit |

| Expense Ratio | Fee charged by fund manager |

| Lock-In Period | Minimum time before redemption (e.g., 3 years for ELSS) |

| Corpus | Total invested + earned amount |

| Redemption | Withdrawal of investment |

🧾 SIP Tax Benefits (2025 Updated Rules)

- SIPs in ELSS (Equity Linked Savings Schemes) qualify for Section 80C deduction (up to ₹1.5 lakh).

- Long-term capital gains (>1 year): Taxed at 10% (above ₹1 lakh profit).

- Short-term gains (<1 year): Taxed at 15%.

✅ ELSS SIPs combine tax saving + market returns — a double benefit.

🎯 Who Should Invest in SIP?

SIPs are ideal for:

- ✅ Salaried professionals

- ✅ College students & first-time investors

- ✅ Homemakers saving monthly

- ✅ Retirees seeking steady growth

- ✅ Anyone with long-term financial goals

If you earn, you can SIP.

🪄 5 Golden Tips to Maximize SIP Returns

- Start Early — Time is your best ally.

- Increase SIP Yearly — Use top-up option.

- Stay Consistent — Don’t stop when markets fall.

- Diversify — Mix equity, hybrid, and debt SIPs.

- Review Annually — Replace underperforming funds.

💬 Real-Life Example: The Power of Consistency

Rahul, 25, started a SIP of ₹5,000/month in 2015.

After 10 years (2025), his total investment: ₹6 lakh.

Portfolio value: ₹12.1 lakh 🎯

That’s double his investment — all because he stayed consistent!

🏁 Conclusion

The SIP full form — Systematic Investment Plan — is more than just a financial term. It’s a habit of disciplined wealth creation.

By starting early, investing regularly, and staying committed, you can make your money work for you — even while you sleep.

Remember, the best time to start a SIP was yesterday. The next best time is today. 💼

❓ Top 10 FAQs About SIP Full Form

1. What is SIP full form in mutual fund?

SIP stands for Systematic Investment Plan, a method to invest regularly in mutual funds.

2. Can I start a SIP with ₹500?

Yes! Most funds allow SIPs from ₹500/month.

3. Is SIP better than FD?

Yes, SIPs generally offer higher long-term returns than fixed deposits.

4. Can I stop or pause my SIP?

Yes, anytime — there’s no penalty.

5. Is SIP safe?

SIPs are market-linked; risk depends on fund type, but long-term investments reduce volatility.

6. Is SIP tax-free?

Only ELSS SIPs offer tax benefits under Section 80C.

7. How long should I continue SIP?

Ideally 5–10 years for compounding to work.

8. How to calculate SIP returns?

Use a SIP calculator (available on Groww, Zerodha, or AMFI).

9. What happens if I miss a SIP payment?

It skips that month; no fine, but ensure balance next time.

10. Which SIP is best in 2025?

Top funds include Parag Parikh Flexi Cap and Axis Bluechip Fund.