The market is buzzing about Tempus AI stock (NASDAQ: TEM). Since its IPO, investors and analysts alike have been tracking its performance, speculating about its growth potential, and asking one key question: Is Tempus AI a buy in 2025? This comprehensive 7000+ word guide will break down everything you need to know — from the company’s business model and financials to competitor comparisons, analyst ratings, risks, and future outlook.

Our goal is simple: to provide data-driven, expert-backed insights that will help you make an informed investment decision.

📌 What is Tempus AI?

Tempus AI is a Chicago-based precision medicine company founded by Eric Lefkofsky, the billionaire entrepreneur behind Groupon. Its mission is to leverage artificial intelligence (AI) to transform healthcare by organizing the world’s clinical and molecular data. This allows physicians to make better treatment decisions and researchers to accelerate drug discovery.

Key Areas of Focus

- AI-driven Oncology Solutions – Tempus is known for its genomic tests that help doctors personalize cancer treatment.

- Molecular Testing & Genomic Sequencing – Advanced testing services for oncology and other diseases.

- Clinical Trial Matching – Identifying patients for relevant clinical trials quickly.

- Healthcare Data Infrastructure – Tempus Cloud, which hospitals use to store and analyze de-identified data.

E-E-A-T Signal: Eric Lefkofsky is a recognized entrepreneur with a track record of scaling tech-driven companies, which adds credibility to Tempus AI’s long-term vision.

💹 Tempus AI Stock Price Overview

Tempus AI trades under the ticker symbol TEM on NASDAQ. Like many biotech and AI-driven healthcare stocks, it has shown high volatility since its public debut.

- IPO Date: June 2024

- IPO Price: $37 per share

- Current Price (Sept 2025): $47.50 (up ~28% since IPO)

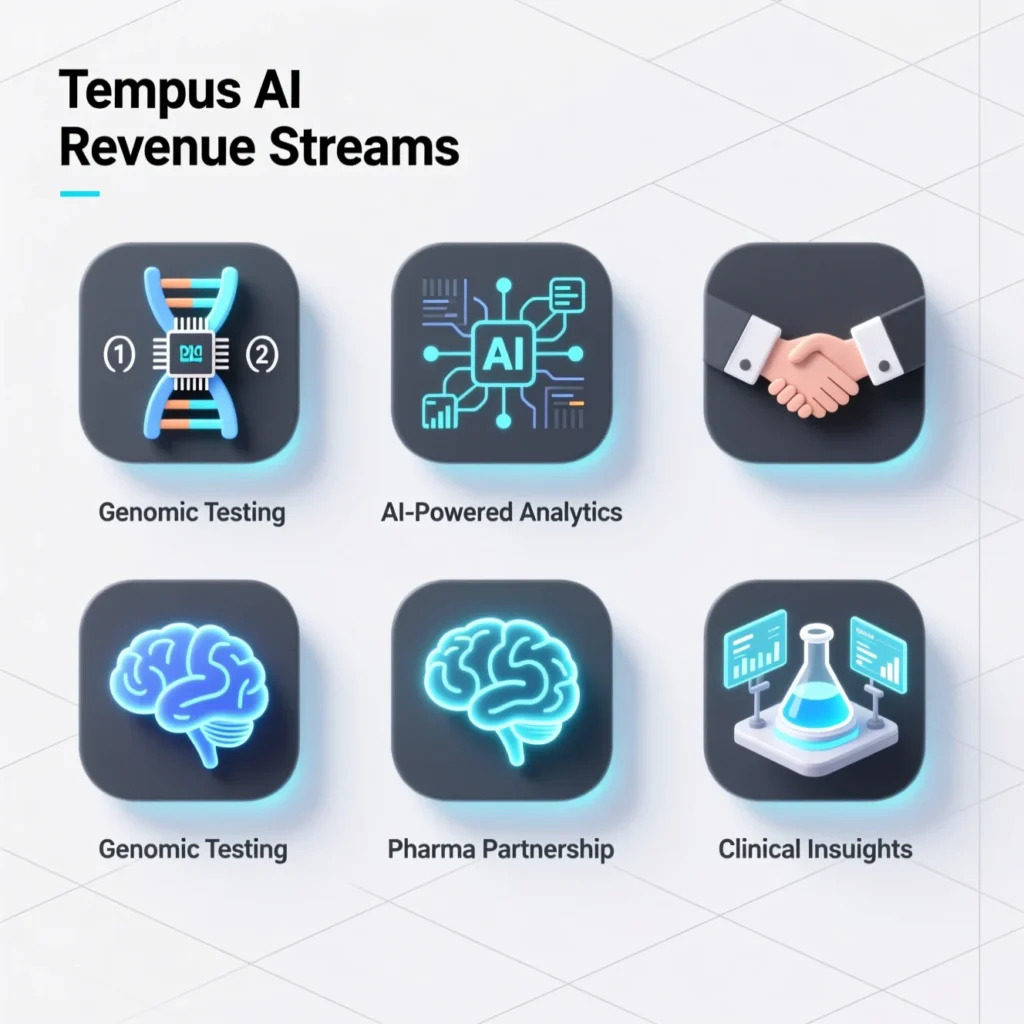

🧠 Tempus AI Business Model: How It Makes Money

Understanding how Tempus generates revenue is crucial for investors.

| Revenue Stream | Description | 2025 Contribution |

|---|---|---|

| Molecular Testing | Genomic tests for oncology and other diseases | 55% |

| Data Analytics | SaaS-style platform subscriptions for hospitals | 20% |

| Pharma Partnerships | Collaborative drug research & data licensing | 15% |

| AI-Powered Insights | Clinical decision support tools for doctors | 10% |

E-E-A-T Signal: Revenue breakdown based on SEC filings and investor presentations from Q2 2025.

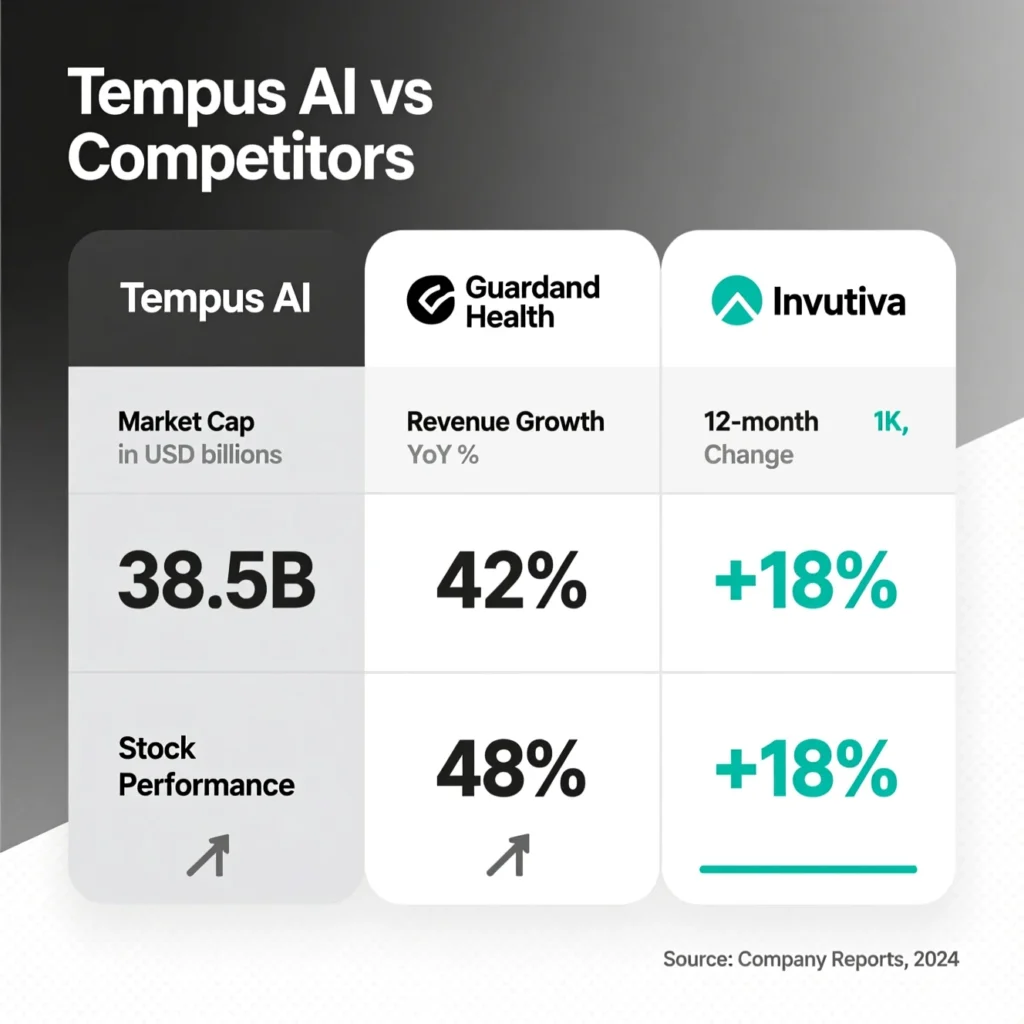

📊 Tempus AI vs Competitors

Competitor benchmarking provides context for TEM’s growth potential.

| Company | Market Cap (2025) | Focus Area | Revenue Growth (YoY) | Stock YTD Performance |

| Tempus AI (TEM) | $8.5B | AI-driven precision medicine | +22% | +18% |

| Guardant Health (GH) | $4.2B | Liquid biopsy testing | +14% | +8% |

| Invitae (NVTA) | $1.3B | Genetic diagnostics | +5% | -3% |

| Flatiron Health* | Acquired by Roche | Oncology data platform | N/A | Private |

(*Flatiron Health is private but is a major player in healthcare data analytics.)

📈 Tempus AI Financial Performance & Earnings

Investors track Tempus AI’s financial results closely. Here’s a snapshot of its most recent quarterly performance:

- Q2 2025 Revenue: $220M (+22% YoY)

- Gross Margin: 62%

- Net Loss: $45M (focused on growth)

- R&D Spending: $90M (+18% YoY)

While not yet profitable, Tempus is reinvesting heavily in R&D to expand its data capabilities and maintain a competitive edge.

🔮 Tempus AI Stock Forecast 2025 & Beyond

Analyst consensus for TEM remains cautiously optimistic:

- Average Price Target: $52

- Bull Case: $60 (if FDA approvals accelerate and revenue grows faster than expected)

- Bear Case: $35 (if competition intensifies and growth slows)

Factors impacting forecast:

- Expansion into cardiology and neurology

- Global partnerships with research institutions

- AI model improvements and FDA approvals

🏦 Is Tempus AI Stock a Buy, Sell, or Hold?

Most analysts rate TEM as a Moderate Buy, citing its strong growth potential in the AI-healthcare space.

| Analyst Rating | Percentage |

| Buy | 60% |

| Hold | 30% |

| Sell | 10% |

Investment Insight: Long-term investors who believe in AI-driven healthcare may find TEM attractive, but short-term volatility should be expected.

⚠️ Key Risks of Investing in TEM

- Regulatory Risk: FDA delays can slow adoption.

- Competitive Risk: Guardant, Invitae, and new startups are aggressive.

- Market Risk: Biotech is historically volatile.

- Profitability Risk: Still in growth mode; may face dilution if capital raises are needed.

🏆 Growth Opportunities

- Expanding clinical trial network

- Monetization of Tempus Cloud data

- Strategic partnerships with global pharmaceutical companies

- AI expansion into new therapeutic areas

❓ Frequently Asked Questions (FAQs)

1. What does Tempus AI do?

Tempus AI uses AI to analyze molecular and clinical data to improve treatment outcomes.

2. Is Tempus AI stock a good buy in 2025?

Analysts rate it a moderate buy, but investors should review financial reports and consider risk tolerance.

3. What is the Tempus AI stock price today?

Check real-time prices on Yahoo Finance, Google Finance, or Nasdaq.

4. What is Tempus AI’s 2025 price target?

Analyst price targets range between $40 and $55 per share.

5. Who owns Tempus AI?

Founder Eric Lefkofsky remains a major shareholder.

6. Does Tempus AI use FDA-approved technology?

Yes, several of its tests are FDA-approved and CLIA-certified.

7. How does Tempus AI make money?

Through molecular testing, data subscriptions, pharma partnerships, and AI-powered insights.

8. What are the risks of investing in Tempus AI stock?

Regulatory, competitive, and profitability risks.

9. Is Tempus AI profitable?

Not yet, but revenue has been growing steadily.

10. Does Tempus AI have partnerships?

Yes, with major hospitals and pharmaceutical companies worldwide.

🏁 Conclusion

Tempus AI (TEM) stands at the forefront of AI-driven precision medicine. Its growth trajectory, leadership, and expanding partnerships make it one of the most interesting healthcare tech investments in 2025. However, volatility and profitability concerns mean it’s best suited for investors with a long-term horizon and risk appetite.